Fear Isn’t the Enemy — It’s the Signal: Trading the VIX with Price, Volume & OI

Fear Isn’t the Enemy — It’s the Signal: Trading the VIX with Price, Volume & OI

What is the VIX and Why Should Crypto Traders Care?

The VIX, also known as the Volatility Index or the "Fear Gauge," measures expected volatility in the S&P 500 over the next 30 days. But here’s what most crypto traders overlook: as institutions flood into the crypto space, the VIX is becoming more relevant to our world too.

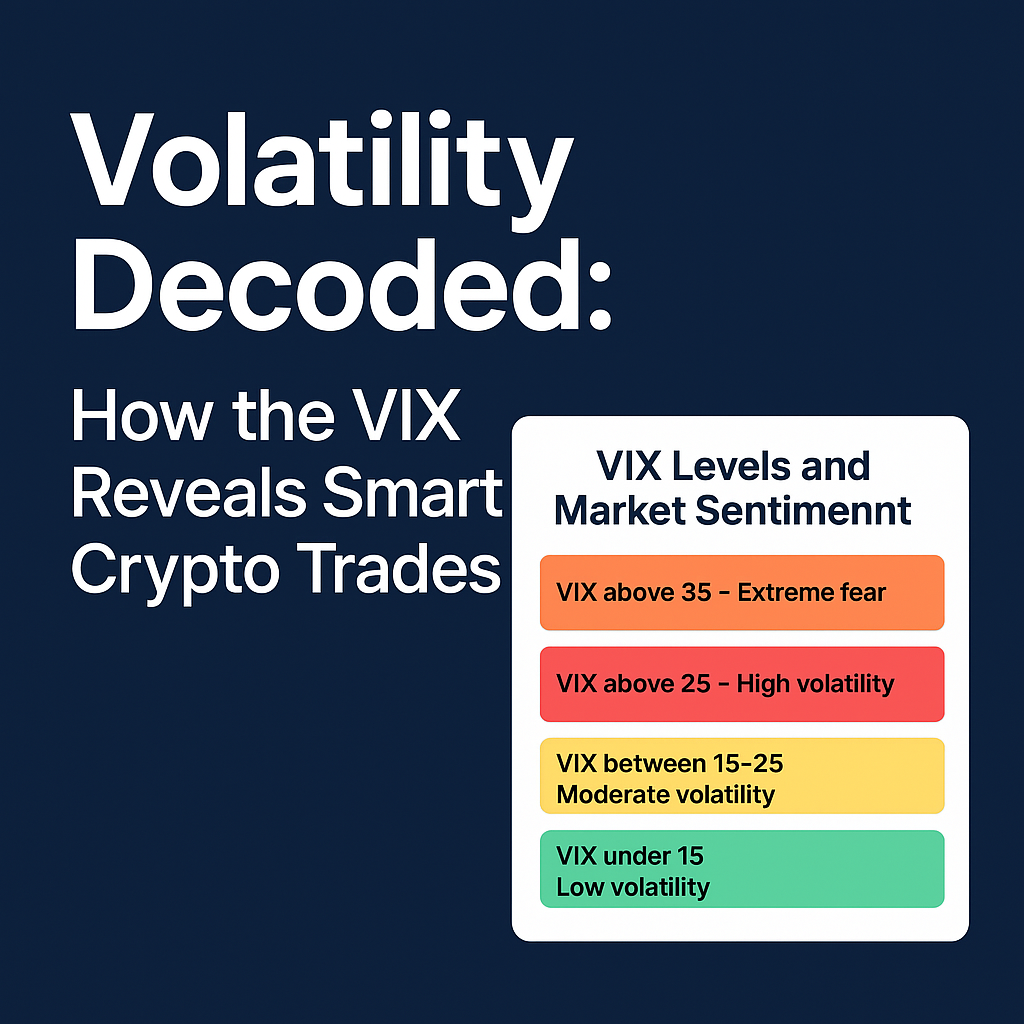

Think of the VIX as a mood ring for the broader financial market:

Low VIX (<15) = Calm, steady markets (sometimes overly complacent).

Moderate VIX (15–25) = Business as usual.

High VIX (>25) = Fear is creeping in.

Extreme VIX (>35) = Full-on panic mode.

And here’s the kicker: fear creates opportunity — if you know how to interpret it using a sound strategy.

Tying It All Together: The VIX and The 3 Pillars of Trading

📈 1. Price Action – "What the Market is Doing"

During high VIX periods, price often becomes erratic. But with tools like Fibonacci retracements, Fair Value Gaps (FVGs), and Anchored VWAPs, we can anticipate where these erratic moves might reverse or snap back.

Strategy Tip: In volatile markets, wait for price to hit strong levels of support/resistance or revisit FVGs. Be patient. Let price come to your plan.

🔊 2. Volume – "Is There Real Strength Behind the Move?"

VIX spikes often coincide with large volume surges. The key is to watch OBV (On-Balance Volume) to detect accumulation or distribution:

If price falls but OBV stays flat or rises → smart money may be buying the dip.

If price rises but OBV lags → warning sign of weak rally.

📊 3. Open Interest – "Who’s Still in the Game?"

Open Interest reveals market commitment. In a high VIX environment:

Falling OI = people are closing positions → potential bottom.

Rising OI during downtrends = new shorts entering → continuation signal.

Using tools like VeloData or Open Interest Suite, you can confirm whether the trend has true conviction or is driven by panic.

Are Crypto Markets Becoming More Like Traditional Markets?

Absolutely. With institutional players (like BlackRock, Fidelity, and hedge funds) now deeply embedded in crypto markets, we’re seeing increased correlation with traditional risk assets. And that means the VIX — once a Wall Street tool — is now a relevant signal in your crypto strategy.

Here’s what’s happening:

Institutions use similar risk models across equities and crypto.

When VIX spikes → they de-risk both.

During market stress, correlation goes to 1 — everything sells off.

“The more institutions adopt crypto, the more crypto behaves like the institutions who hold it.”

Final Thoughts: Use VIX as Context, Not a Trigger

As crypto becomes more mainstream, VIX is becoming a mood indicator for our trades. It won’t tell you when to enter — but it gives powerful context:

VIX up = tighter stops, lower risk.

VIX down = environment for trend continuation.

Always pair VIX insights with your core system: Price Action, Volume, and Open Interest. When all three pillars align with market emotion (VIX), you’re not just guessing — you’re trading with confidence.